Growing a Consumer Subscription App

How subscription apps can use metrics to grow strategically

David Barnard

Whether you built an app as a personal passion project or with your eye on a profitable exit from the onset, understanding how investors think is essential.

Technology investment banker Eric Crowley, Partner at GP Bullhound, has produced the GP Bullhound Consumer Subscription Software Report for the past three years. The report presents rare research about the growing industry, exploring the trends and opportunities in the CSS ecosystem.

While the report is intended for bankers and investors to gain a broader perspective on the short-term and long-term viability of CSS investment opportunities, it’s also a valuable resource for app developers themselves. In an interview on the Sub Club podcast, Eric shares the major findings from the report. He discusses the importance of metrics, particularly the impact of LTV and CAC and how CSS companies can grow strategically.

ATT Is an Opportunity for Subscription App Developers

The CSS model faces growth challenges with the changes in Google and Apple’s App Tracking Transparency policies. “It’s a seismic shift throughout the industry because it’s something that impacts everyone,” says Eric. “Everyone has to be aware of these changes and have a plan for them.”

Removing or reducing tracking ability significantly impacts a business’s ability to leverage paid ads and social media marketing in the customer acquisition process. For many marketing teams, it’s been a forcing function to enhance their organic marketing efforts.

However, Eric doesn’t believe that app developers should feel discouraged. The adjustment is a short-term pain point, and he’s bullish that app developers will adapt and find alternative approaches.

Using instant feedback from users and continuously iterating on product functionality are necessary areas of focus for app startups looking to drive organic growth. Single-pronged marketing strategies, particularly those that rely upon Facebook, are no longer viable.

Also Read: A Practical Guide to Apple Search Ads

Eric predicts that marketing teams will be quick to pivot. By adapting to the new restrictions, app startups will “really focus on organic ways of acquiring customers instead of just pumping ads through Facebook and trying to find someone who fits their profile.”

Honing in on an app’s target audience, defining your niche, and then helping target customers find your app will support long-term growth that endures.

Measuring Growth Isn’t Always Cut and Dry

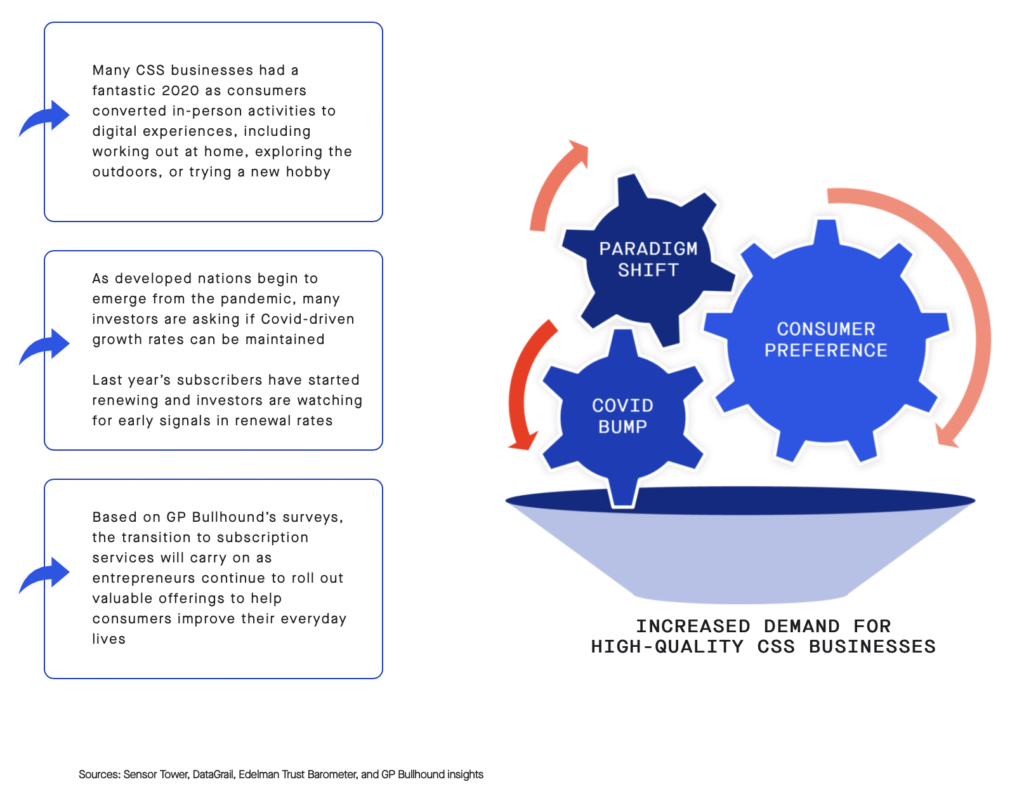

CSS growth rates took off during the pandemic in 2020 and 2021. With so many people having time to invest in hobbies, apps that already benefited from the removal of in-person conversations also received a significant COVID bump. As a result, many CSS companies experienced an accelerated growth period.

“The pandemic…really opened up people’s eyes to other options from what they’d been doing for the last 20 years,” Eric notes.

Companies like Duolingo and Bumble went public, which ignited interest in the public investor space for businesses embracing a similar subscription-based model.

“The public market has really woken up to this business model, the power of it, and understanding its public markets. [Investors] do a lot of pattern matching. If they’ve seen something be super successful, they look for something that looks similar to that,” says Eric.

But he warns that a direct comparison between SaaS and CSS companies is problematic because the two models rely on different metrics. Traditionally, investors want to see high revenue growth and high net revenue retention, which are appropriate metrics to consider when investing in a SaaS company.

While high revenue growth is just as important when investing in a CSS, it’s critical to explain to investors why looking for net revenue retention numbers north of 120% just isn’t realistic.

Other than apps like Tinder, which have developed consumable in-app purchases (IAPs) to help users boost their profiles, most CSS model companies are solely subscription-based, which inherently means that net revenue retention metrics don’t speak to the company’s viability.

This example is one of many outlined in GP Bullhound’s report, which breaks down why comparing SaaS metrics to CSS metrics is like comparing apples and oranges.

Instead of looking at net revenue retention, Eric believes that the ability to demonstrate lifetime value (LTV) is a better indicator of profitability. However, even understanding LTV in the subscription-based app space comes with an important caveat.

To Win Over Investors, Find the Locals

Looking at the LTV to Customer Acquisition Cost (LTV/CAC) ratio is a good metric for showing the efficiency of your marketing spend, but relying on LTV and CAC without the right context is problematic. As Eric points out: “The problem with this metric, and lots of other metrics, is that they are derived from an average.”

Eric believes the LTV formula presents several issues for CSS companies for several reasons:

- LTV assumes that all users eventually churn at an average rate.

- It ignores upsells and subscription renewals.

- It doesn’t account for the different types of user profiles, downplaying the power of the “local” — a user who is likely to stay loyal to the company for life.

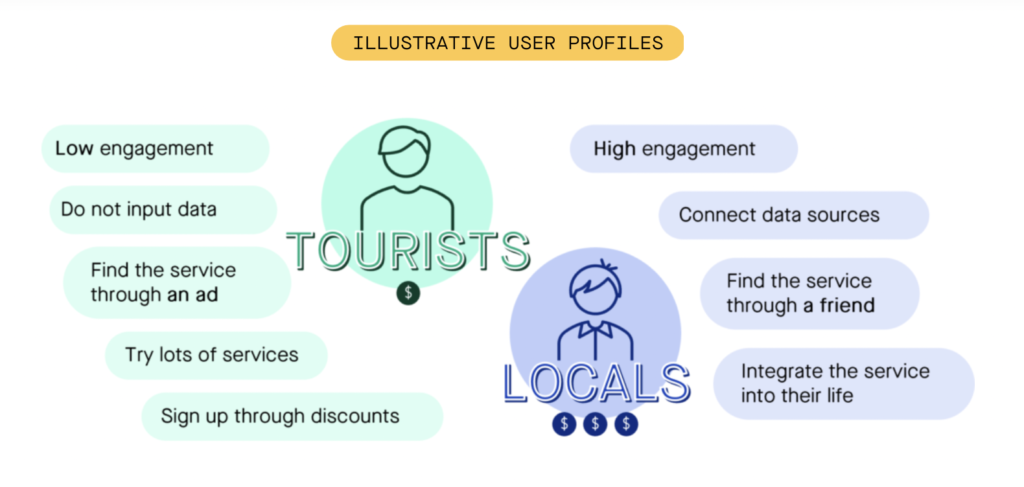

He breaks users into two cohorts: “tourists” and “locals.” Tourists are quick to subscribe but also quick to churn; they are likely trying lots of different services, are signing up through discount offers, and find the app through paid advertising. On the flipside, locals often discover the app through organic efforts; they are high-engagement users who integrate the service into their everyday lives.

When the behaviors of these two cohorts are averaged (as is the case with most metrics) your data becomes skewed. If you use an average LTV with a 30% churn rate, you will lose every user in three years, which paints a dire and inaccurate picture.

Investors will want to know what the average LTV is, but a founder’s job is to also be able to dial into each of these cohorts and articulate the inherent value in locals-focused numbers.

Eric suggests finding ways to identify your locals and looking at engagement metrics based on user profile. Discussing your average LTV is essential because it’s important for CAC payback, but be sure to also highlight the potential of your locals and address how your marketing efforts are targeting these highly engaged and highly profitable users.

Become a Master Storyteller — With Your Data

For founders seeking funding, success often comes down to how you articulate your company’s value. Investors want to understand answers to key questions such as the following:

- What’s the story of your business?

- What are you trying to accomplish?

- How are the answers to these questions tied to metrics?

Explaining how CSS metrics should be assessed within the industry (and how the metrics differ when applied to SaaS companies) is important for those looking to win over investors new to the CSS space.

It’s important to present metrics, including LTV to CAC ratio, user growth rates, gross margins, churn rates, free-to-paid conversion rates, and sales efficiency. However, if not contextualized for the investor, these numbers can be left up to interpretation (or misinterpretation). As a result, it’s essential that founders possess a deep understanding of not just the metrics themselves but also how they contribute to their company’s evolution. “If you don’t understand these metrics, it’s hard to tie that to the story,” Eric says.

When you can connect the dots between the numbers and your users’ behavior, particularly your locals, you’re able to demonstrate the real value of your business, helping investors understand why yours is an investment worth making.

This article is based on an episode of our podcast, Sub Club, which explores best practices and insider secrets for scaling your app. Subscribe via Apple, Google, Spotify or wherever you get your podcasts.

In-App Subscriptions Made Easy

See why thousands of the world's tops apps use RevenueCat to power in-app purchases, analyze subscription data, and grow revenue on iOS, Android, and the web.