App engagement metrics: 5 essential metrics for subscription apps

Effective monetization begins with an engaged user base.

Peter Meinertzhagen

If users of your app are not staying engaged and coming back to your app, then you’re going to struggle to build a business.

There’s a constant balance of areas vying for your attention: Do I drive more growth and downloads? Do I optimize my pricing and monetization? Do I focus on driving more app engagement?

As your app grows and matures, you’ll have flywheels in motion for each of these areas. But in your app’s early stages, engagement is where you’ll likely devote most of your time. In the words of Nir Eyal (thanks to Babbel’s Sylvain Gauchet for sharing this gem), “engagement is more important than growth, at the early stage”, otherwise users will leave and your app is a leaky bucket.

Your app engagement optimization begins with monitoring the right metrics. For subscription apps, those metrics also need to include monetization and revenue so that you can qualify the engagement you’re seeing.

By the end of this article, you’ll have an understanding of which metrics subscription apps can measure to understand user engagement (and how to measure them), and how to use these metrics to drive more user engagement and ultimately revenue.

We’ll be covering five metrics in this guide:

- DAU/MAU

- Session length/depth

- Conversion rate

- Churn rate

- Realized lifetime value per customer

1. Daily active users (DAU) / monthly active users (MAU)

These are fundamental indicators of an app’s health and user engagement. For subscription apps, maintaining a high level of daily or monthly active users is critical for sustained revenue. We begin with active users because they fuel the metrics that follow.

Defining active users: What constitutes an “active user” in your specified time period will depend on your product analytics tool and how you’ve got it set up. With a sophisticated tool like Mixpanel or Amplitude you will be able to define exactly which event(s) make a user “active”. This is important because how you define “active” will depend on the nature of your app and your level of maturity (early on, for example, you might be less strict about which events define an active user).

Data-driven engagement: Focus on strategies that drive regular and meaningful user engagement. Utilize product analytics tools to identify which app features or content are most engaging. Personalization plays a key role here — by customizing user experiences according to their preferences and behaviors, you can enhance user retention and encourage more frequent app interactions.

Remember, for subscription apps, consistent user engagement is a key driver for sustained revenue growth.

2. Session length/depth

Session length and depth go hand-in-hand with monitoring your active users, however, rather than measuring consistent engagement over time, they measure the quality of engagement in those “active” sessions. For subscription apps, understanding these aspects of user behavior is crucial, as they are often directly correlated with higher subscription rates and lower churn.

Measuring engagement: Session length refers to the duration of a user’s interaction with the app in a single sitting, while session depth looks at the levels of engagement or the number of interactions within the app during that session.

Predicting subscription likelihood: Longer session lengths and more in-depth engagement typically suggest a higher value proposition for the user, increasing the likelihood of converting free users into subscribers.

Tailoring user experience: Analyzing session data can help in identifying which features or content keep users engaged. This insight is invaluable for tailoring the user experience to encourage longer and more frequent interactions.

Strategic improvements: By understanding the patterns in session length and depth, you can make strategic improvements to your app. This might involve enhancing certain features, streamlining the user interface, or introducing new content that resonates with your audience.

If you’re using RevenueCat, you can integrate with a number of analytics platforms to see how product engagement metrics like daily/monthly active users and session length/depth relate to your subscription metrics.

3. Conversion rate

Conversion rate answers the question: How well does your app turn downloaders into either trial-starts or subscribers? Or, more broadly, it’s the percentage of users who move from one stage of a funnel to the next.

Multiple conversion funnels: When we talk about “conversion rate” we could be referring to a number of conversion funnels. For apps with a trial, you’ll be optimizing your trial start conversion rate (how well you turn your downloaders into trials) and trial conversion rate (how well you turn trials into paying subscribers). If you don’t offer a trial, you’ll be optimizing for download to subscriber conversion rate — some of those downloaders will be free users if your app is using a freemium model.

Optimizing your trial length: Data shows that trial length can significantly impact conversion rates. For instance, shorter trials may yield lower conversion rates compared to longer ones. However, the ideal trial length varies based on the app’s specific context and user engagement strategy. Check out what’s a good trial conversion rate? for more.

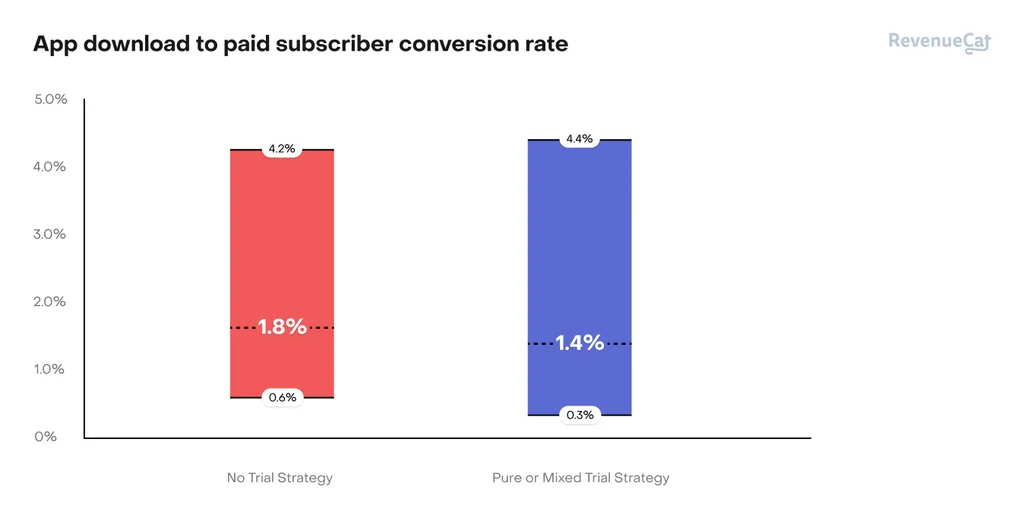

Maximizing download-to-paid-subscriber conversion: Regardless of a trial’s presence, achieving a strong download-to-paid subscriber conversion rate is crucial. Most apps experience conversion rates below 2%, with top performers reaching around 4%. The variance in conversion rates underscores the potential gains in refining your conversion strategy. The key is to actively engage users post-download, whether through a trial, freemium features, or a compelling hard paywall. Clear communication of your app’s value and showcasing features that underline this value are essential in nudging users towards becoming paying subscribers.

4. Churn rate

Churn rate measures the percentage of active subscriptions lost during a given period that have not yet resubscribed. This metric is crucial for subscription-based models — a stable or declining churn rate signals a healthy, growing business. Reducing churn and retaining users is essential for maintaining steady revenue.

New user churn vs. subscriber churn: New user churn refers to the overall loss in your app’s users while subscriber churn (which is the churn we mean in this article) refers specifically to subscribers becoming non-subscribers. Both are important but they represent different outcomes. When it comes to reducing new user churn (and turning new users into trials and conversions), onboarding is vital. We’ve teamed up with OneSignal to provide an onboarding messaging tutorial to help get you started.

Segmentation for insights: If you segment your churn data (like you can do in Charts) by factors like country or subscription duration you can identify which subscriber segments have the lowest churn (which could be an indicator of stronger product-market fit).

Win-back ideas: You can do your best to keep users engaged but it is inevitable that some users will cancel. A cancellation doesn’t have to mean a loss, however. You have plenty of win-back options to experiment with, such as offering discounts to lapsed users or using in-app messaging and cues to remind users of the premium features they’re due to lose when their subscription expires. We’ve put together a list of win-back campaign ideas to inspire you further.

5. Realized lifetime value per customer (LTV)

Realized lifetime value (LTV) per customer is a crucial metric for subscription apps. It measures the actual revenue generated by a customer cohort over their relationship with the app, providing a comprehensive view of customer value. Realized LTV is often used interchangeably with average revenue per user (ARPU), however, ARPU measures revenue over a specific period of time rather than a customer’s entire relationship with the app.

Defining realized LTV: Realized LTV per Customer is calculated by dividing the revenue (minus refunds) generated by a customer cohort by the number of customers in that cohort. This metric evolves over time, reflecting changes in customer behavior and monetization patterns.

Strategic insights from realized LTV: Utilizing LTV data can directly inform your user engagement strategies. By identifying features or content that contribute to higher LTV, you can refine your app to better align with what users value most, enhancing engagement and, in turn, driving revenue growth. Over time, as you improve your product, you should be

Optimizing pricing with realized LTV: Realized LTV should be your standard measure for evaluating pricing experiments, providing insights into the long-term revenue impact of various pricing strategies. RevenueCat Experiments facilitates this by tracking Realized LTV across different pricing variants, enabling data-driven decisions to optimize your subscription pricing for enhanced customer value and revenue growth.

Wrapping up on app engagement metrics

Each of the app engagement metrics discussed in this article provide a unique lens into user engagement in your app, helping you understand whether your app is useful and solving a user problem. By including metrics that incorporate some element of your monetization and revenue, like LTV, we go a step further and help you understand whether the app is valuable.

Are there particular metrics where your app excels or falls short? What do these patterns tell you about your users and your app’s value proposition?

To monitor and track the health of your subscription app across 15+ subscription metrics, use RevenueCat Charts.

In-App Subscriptions Made Easy

See why thousands of the world's tops apps use RevenueCat to power in-app purchases, analyze subscription data, and grow revenue on iOS, Android, and the web.