The ultimate guide to Apple Search Ads best practices

Why it's a channel worth exploring to grow your app

Thomas Petit

Apple’s only current advertising offer, Apple Search Ads (ASA), is a part of the marketing mix of most mobile marketing teams running paid acquisition. I started on the platform the day it launched in late 2016, spent eight digits managing budgets directly, and audited dozens of accounts.

For those less familiar, I’ll explain first why it’s such a unique channel in many ways and what makes it worth exploring to grow your app. Then I will detail how I start and structure accounts in line with Apple Search Ads best practices to extract maximum value.

1. Why Advertise with Apple: A Unique Paid Channel

Paid social networks dominate the mobile app advertising space (e.g., Facebook/Meta, Tiktok, and SnapChat) and in-app advertising ad networks (Applovin, Vungle, Adcolony, Ironsource, etc.).

There are also Google App Campaigns, called UAC by practitioners, another option with confusing logic due to mixing placement types without much control or transparency. There are alternatives, but the ones above span most ad spend on app ads.

And then there’s Apple Search Ads, a channel fundamentally different from any paid app marketing channels for several reasons.

What Are Apple Search Ads? A Prime Placement in the App Store

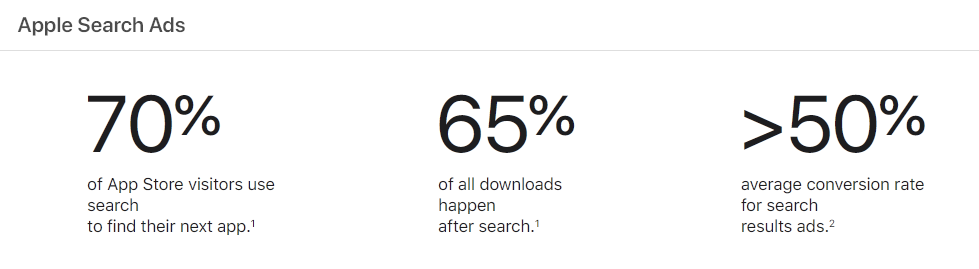

Apple says that two-thirds of all downloads happen after a search in the App Store, but I’m skeptical about that specific data point since it’s a blend of brand name search and general keyword search.

Either way, ASA offers unparalleled placement directly within the App Store, which is visited by 600 million unique visitors every week.

Source: Apple

Unlike most other ad placement, it’s not located in a third-party app—the App Store is considered a system app, and it isn’t downloaded or removable and doesn’t respect the usual ad formats you get elsewhere.

It’s also the only inventory you buy directly from the platform, which protects you against the large-scale fraud horror stories that have long affected many other sources of inventory on mobile.

ASA Can Be Run at Low Scale

Other major ad networks provide sophisticated install and event optimization, powered by machine learning. This way of buying and selling programmatically has proven to be very powerful, but it comes at a price: making the process efficient requires scale; to put it bluntly, this means large ad budgets.

iOS 14.5 and the switch from user-level to aggregated data further increased the scale required to optimize these channels, as data fed back to networks gets sampled and blurred. These types of campaigns simply can’t be run effectively by smaller apps with monthly ad budgets in the thousands of dollars.

ASA has more primitive logic, with no post-install optimization. It’s primarily optimized and billed at the click level, a metric Apple calls a “tap,” hence the acronym CPT for Cost Per Tap. The benefit is that this makes ASA accessible at pretty much any scale, even the smallest. Adhering to Apple Search Ads best practices, even campaigns with smaller budgets can be successful.

For limited ad budgets in the early phases of growth, Apple is a great place to start advertising until enough money can be invested into more sophisticated channels. As a bonus, if you’ve never advertised on ASA before, Apple will give you your first $100 in ad spend.

Apple Search Ad Tracking: A Huge Attribution Advantage

Until iOS 14.5, the ASA measurement framework, called iAd, was fully dependent on the advertising ID (the infamous IDFA), which led to serious reporting issues. Apple was showing ads to every user but only reported those whose IDFA was accessible.

Since Q2 2021, marketing measurement has changed fundamentally: Apple now provides a new attribution framework for app-to-app campaigns called SKAdNetwork, which most app marketing channels rely on.

Due to being a “system app,” the App Store is not considered third-party, hence measuring ASA doesn’t fall under Apple’s definition of “tracking.” While some may see this as self-preferencing, it is a huge attribution advantage. The difference between iAd and AdServices is that with AdServices you can measure ASA performance at the user level for all users, regardless of AppTrackingTransparency status (ATT, Apple data consent).

This difference has attracted even more attention to the channel, which is estimated to have grown in ad spend from $500 million in 2018 to $5 billion in 2021. “Apple’s advertising business has more than tripled its market share in the six months after it introduced privacy changes to iPhones,” the Financial Times estimates. “It’s like Apple Search Ads has gone from playing in the minor leagues to winning the World Series in the span of half a year,” said Alex Bauer.

Personal tip: the numbers you get from different attribution methodologies aren’t directly comparable. You can’t put ASA and other networks side by side on the same metric without complex modeling. Consider performance carefully when comparing.

Insights Galore!

The biggest advantage of running ASA is the unique granularity of data it provides.

The ability to select specific keywords and get detailed information about various users’ intent opens up invaluable insights that can be translated into action. Without running ASA campaigns, it’s impossible to get detailed search details from organic data (AppStore Connect doesn’t disclose keywords within Search).

The same applies to the Play Store, as Google doesn’t report on keywords in its ad product and doesn’t even let advertisers choose keywords to bid on. Google doesn’t provide keyword data to its app advertisers on either platform. ASA is the only way to get reliable details of keyword performance for app advertisers.

The data you gather from ASA campaigns can directly inform your App Store Optimization (ASO) strategy in an unparalleled way, providing understanding of not only the volume of queries for different keywords but also, more importantly, user behavior.

This includes behavior within the store (to what extent users click and install when your app shows for specific keywords) and how this cohort develops (which keywords generate users with the highest retention and/or conversion rates). Using Search Ads and App Store Optimization together can quickly become a best practice to grow on the App Store.

ASA is also extremely valuable when monitoring metrics, specifically on your brand name. Search is at the bottom of the awareness funnel, and it’s usually a very good proxy to gauge the impact of other marketing actions. The volume of searches on your brand name provides information on long-term trends about your app’s popularity and the efficiency of your marketing activities.

It’s also a great proxy for short-term actions and channels that are typically hard to measure and attribute, such as influencers or TV. Advertising on Apple Search Ads opens up a world of insights you can’t get anywhere else.

The Other Side of the Coin

As we’ve seen, ASA offers lots of advantages no other network can provide. It’s never all rainbows and unicorns, though, and the channel also comes with a few drawbacks:

- It is often not as scalable as paid social or display. The number of users searching in the App Store for keywords relevant to your app is finite, and ASA is very rarely one of the biggest channels in spend as advertisers deploy more budget.

- No ad networks are without flaws, but Apple’s interface is pretty clunky and can quickly get time-consuming. Several third-party tools built on top of the API can help you with this—as well as automation, reporting, and more—such as SplitMetrics Acquire, SearchAds.com, or Ironsource Luna. I find them helpful to manage large accounts, but you don’t necessarily need them on day one.

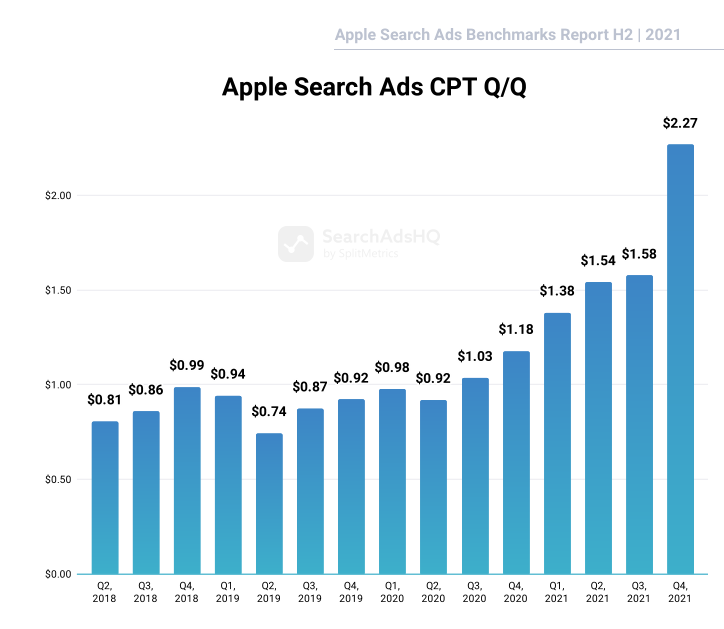

- There is great variance across verticals, but ASA is typically not cheap. Many apps want this premium inventory, which has attracted even more advertisers since iOS 14.5, and inflation can be scary. SplitMetrics Acquire estimates the CAGR in price at around 7%!

Don’t be too scared by these raw values, though: They vary a lot across countries and verticals, and a significant part of this recent increase is due to extreme competition within fintech, in particular, with crypto apps playing in a different league.

Source: Apple Search Ads benchmarks report H2 2021

Ready to get started? In the next part of this Apple Search Ads best practices guide, I’ll get more practical and explain how to start from scratch and set up a strong account structure to maximize performance and insights.

2. How to Set up Apple Search Ads: Structuring Your Account from Scratch

With the context above, let’s drill down into specific, practical inputs that should help you get started without falling into some of the usual early mistakes.

Avoid ASA Basic

Apple provides two flavors of ASA: Basic and Advanced. While Basic can sound enticing at first glance due to it requiring minimal management, I strongly recommend against it. You will lose the most valuable part of ASA, the insights, as well as be blind to the keywords your ads are placed against.

Source: Zach Shakked

Creatives and Store Metadata

Apple will create the ads from the material displayed in your App Store listing (“metadata”) for the localization users specify in their settings: “Locales” are country/language combinations. You don’t have to upload specific creatives for ASA, although you can, through Custom Product Pages.

There are many other reasons beyond ASA to craft your store listing carefully, but you may consider editing the listing specifically for the channel. For instance, you can consider adding keywords you try to bid on but don’t use currently, improving how Apple gauges your app’s relevance. The synergies of ASA and ASO go both ways: ASA can inform how to improve ASO, and ASO edits can boost your ASA performance.

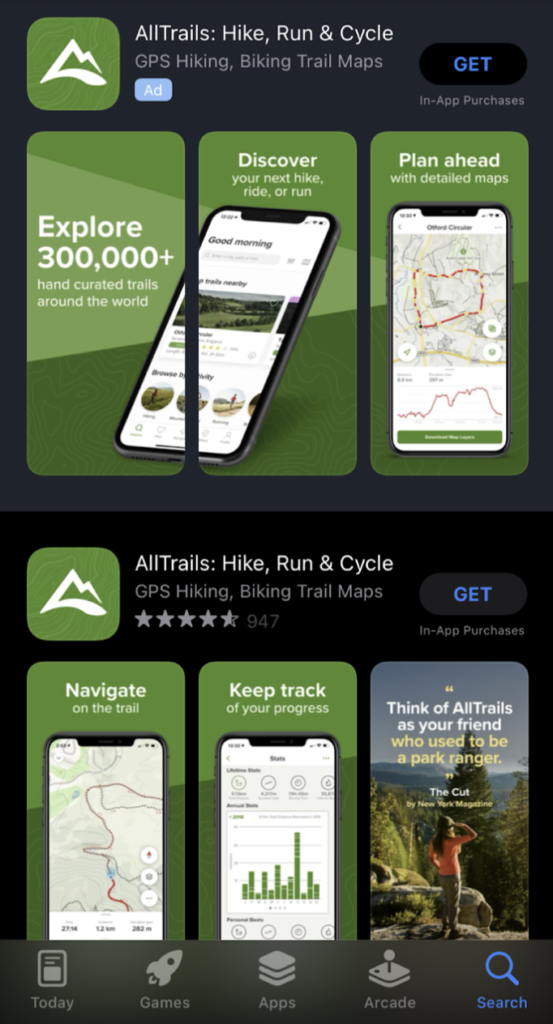

Remember that if you appear twice in search—once in the ad and once organically—Apple will not show the same screenshots. If you use portrait screenshots, the first three will appear in the ad and the next three in the organic listing, as illustrated with AllTrails below. Keep an eye on how those look in isolation.

Brand Campaigns

I am often asked whether to bid or not on your app name. I’ll keep a more detailed take on this for another post, but spoiler alert: If you don’t defend your brand, another app will show up on top of yours, potentially stealing traffic that took a lot of effort to bring to the App Store in the first place. Hence the term “brand defense.”

I strongly recommend having brand campaigns entirely separated from all others. Beyond that, my recommendation is to treat “ASA brand” and “ASA non-brand” as two completely different channels, each with their own goals. The return on ad spend you can expect from each is very different, as is the very nature of defensive vs. offensive activity.

Campaign Structure

Outside of your brand terms, I recommend structuring campaigns as follows:

- One campaign for generic terms. Examples: “dating app,” “fitness,” “video editor for TikTok,” or “music player.”

- One campaign for “competition” terms, which may include not only direct competitors but any terms that are typed with the intent to look for another app. Some people call this campaign type “brand offense.”

- One “discovery” campaign, where you explore additional keywords you haven’t found in your own research. See details for match types below: this campaign is the only one where I would use Broad Match or Search Match: the other three (brand, generic, and competition) only running with Exact Match targeting (see below for more).

Remember that App Store searches are very different from web searches: They are a lot more concentrated on the short tail and much more “branded.” The vast majority of searched terms are other apps, not generic keywords. Often, the competition campaign is where you’ll find the most potential search volume but also high prices that create a challenge to get solid financial returns.

I’ve outlined four campaign types, but then you also have to deal with geographies (“Storefront,” in Apple’s vocabulary): There are 60 of them available at the moment. I personally prefer to have most countries separated to be able to understand performance separately, but to avoid having 4×60 campaigns in your account, you may want to consider bundling some countries together—usually the smaller spenders.

When bundling, I typically avoid having countries with very different inventory prices together (for instance, South Korea and Pakistan). My recommendation is to keep your most strategic countries on their own, especially the US. There is an option to quickly duplicate an existing campaign and then edit the geography—make sure to edit credit line options in this case, or the campaign may not start.

Match Types

Apple offers three ways to bid on keywords: Exact Match, Broad Match, and Search Match. The last of these is a type of targeting where you don’t need to input any keyword—you can let Apple serve what it believes is relevant to your app, given what can be read from your store listing.

Broad Match and Search Match are said to provide terms that are related to your keyword or your app. In my experience, they’re both extremely broad, often triggering completely unrelated terms. For this reason, as mentioned earlier, I strongly recommend using Broad Match and Search Match only in a separate campaign (discovery), while brand, generic, and competitors only use Exact Match.

How to Manage Search Terms

A “keyword” is what you bid on initially, while a “search term” is what a user searches for. In Exact Match, Apple will match your input closely, permitting only variations for example, “buy shoes” may match “buy shoe” but would not match “purchase trousers.” In discovery, you may find some surprises. Hence, you want to occasionally check the Search Term tab in your ad groups, ideally by extending the timeframe to have higher volumes of data.

An important point is to remember to make good use of negative keywords in your discovery campaigns to remove what you already bid on elsewhere and avoid analysis confusion. Every Exact Match keyword I bid on I would exclude from discovery—especially brand terms! Look carefully at close variations, too.

When you discover new search terms in discovery, you don’t get detailed performance for each: Metrics are reported on the keywords you bid on, not the search terms users look for. A more advanced tactic, pioneered by Phiture, is to have a “probing” group of keywords where you assess performance on Exact Match before dropping them onto generic and competition.

Bidding Options

Apple lets you bid for each tap (click) or set a CPA goal to cap the cost per install. You can’t bid on post-install events here. CPM bidding is only available for the “Search Tab” inventory, that I would recommend avoiding at the beginning.

In most cases, I recommend sticking with ASA’s main bidding option, Cost per Tap. The CPA bidding often reduces volume significantly without bringing better performance. That’s an option I often use only in discovery, but as with many things in paid acquisition, it’s all about trial and error until you find what works for your situation.

Ad Groups Structure

Once your campaigns are set up, there are many different ways to organize your ad groups, each with pros and cons:

- I’ve seen simple accounts drop all keywords into the same ad group, which is convenient for keeping the structure lean initially.

- Several accounts group keywords by similar meaning, such as grouping everything related to a specific theme or a group of competitors operating in a particular subspace of your vertical. This helps you understand the performance of each group while bundling keywords together.

- Others bundle keywords by the value they generate—lifetime value (LTV) ad groups—to bid on them according to their ROI goals. Of course, you only know LTV later on, so you might be moving keywords across various ad groups organized by tiers.

- Some professionals use the Single Keyword Ad Group (SKAG) strategy, where each ad group only gets one keyword. I find this cumbersome in practice and wouldn’t do that for each keyword if you’re using the interface to edit, but for high-volume terms concentrating a lot of ad spend, it’s valuable to keep them apart this way.

ASA practitioners each have their own methods, and the decision to structure ad groups mainly depends on who operates the account. I don’t think there’s one way that outperforms all the others. I use a mix of all these—meaning groups, LTV tiers, and SKAG—depending on the scale of each.

I may have a few very high-volume keywords in their ad group, bundle keywords with similar meaning and performance together, and use a “tutti-frutti” ad group where I drop longer tail keywords, usually with lower volume or performance, until I figure out if some are worth splitting differently.

Audience Targeting

An additional complication for ad groups comes with specific targeting. You have the option with each ad group’s settings to show your ads to users depending on their device (iPhone or iPad), age, gender, location as well as whether they are new users or “returning users.”

Be careful here because “returning users” covers a variety of cases, including users who already have the app on their device and lapsed users who had it in the past (or on another device) but not anymore.

At first, I would recommend starting with none of these targeting options, grouping everything, and later evaluating the relevance of testing specific cases. Of all these options, new vs. returning users is typically one I like to split at some point (to gauge performance levels, which often differs) and bid accordingly. That’s especially true for brand defense campaigns.

If you’re just getting started, I recommend keeping it simple: four campaigns, each with just a few ad groups based on your intuition of what makes sense to group (for example, direct vs. indirect competitors) and no audience targeting.

Then, as you evaluate scale and performance, you may expand on the go by creating additional ad groups to group specific queries or test how audiences react.

Daily Management: How to Optimize and Scale Apple Search Ads

Once the structure is in place, the game is all about getting more scale and better performance. The day-to-day work consists of the following actions:

- Monitoring spending level and performance based on your own goals. Remember to look at brand and non-brand campaigns separately!

- Managing discovery terms, moving some into probing, Exact Match, or just adding as negative keyword if not relevant.

- Increasing or decreasing bids depending on volume—how big is your share of voice on this keyword, and is there an opportunity to scale further?—and performance—how far off are you from the KPI you’re trying to achieve? Do you need to cap bids further down to improve ROI?

You can try a lot more, but this should set your process up until you drill down deeper. You can act on several levers, although you’ll find that they often conflict—the more scale you want, the more the performance might suffer.

Phiture developed an “ASA Stack” that can help you consider which actions to take depending on your use case.

Pitfalls to Avoid

All of the above may sound like a lot, but it can be managed if you are careful to avoid common mistakes. Make sure you follow these key tips:

- Have the AdServices attribution framework in place to look at performance beyond installs. You want to understand which keywords bring you valuable retained users, trials, and revenue.

- Avoid ASA Basic, which would cause you to run blind.

- Keep brand terms separated in your campaigns and, perhaps most importantly, your reporting.

- Only use Exact Match, except in discovery.

- Navigate between scale and performance by revisiting your bids regularly.

Apple Search Ads Best Practices: In Summary

Apple Search Ads offers a unique route into unparalleled insights. Campaigns can be run efficiently with low budgets, making it a prime candidate when starting paid acquisition. It’s also the only channel you can measure fully on iOS, at no cost if needed.

You will want to properly structure your account to maximize value while limiting maintenance time. Implement regular small tweaks to find the right balance between scale and performance.

For more Apple Search Ads best practices, feel free to join the conversation on Sub Club with other subscription apps discussing the topic, or reach out to me on Twitter.

In-App Subscriptions Made Easy

See why thousands of the world's tops apps use RevenueCat to power in-app purchases, analyze subscription data, and grow revenue on iOS, Android, and the web.