A practical guide to Google app campaigns

Demystifying Google app campaigns: a deep-dive into the potential, challenges, and optimization strategies for app promotion success.

Thomas Petit

Formerly known as Universal App Campaigns — and still largely named “UAC” by practitioners — Google app campaigns (GAC) is the app ads product from Alphabet. It’s a major advertising channel for apps and games, covering both Android and iOS.

If you come from the web side of marketing, GAC are the mobile app ads version of “Performance Max”. Except that there’s been no other way to run campaigns for apps for years — no manual campaigns, no keywords!

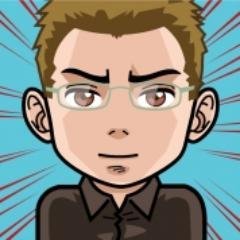

App campaigns are a unique acquisition channel in many ways, the biggest differentiator being the inventory available — ads will show up across various placements including:

- Google search (web and app, discover) and Google search partners

- YouTube

- Play Store search (Android only)

- Play Store “display” (Android only)

- Google Display Network, mostly Admob (display ads in other apps)

The other specificity of GAC is that it runs mostly automated by Google, with very few levers given to advertisers. You can’t choose which placements to advertise on (no keyword, app or channel settings), nor target specific audiences or devices.

GAC offers three different campaign types. “App install” is the core offering, but you may also consider running app engagement campaigns (i.e. retargeting) and pre-registration campaigns (for apps in early launch on Google Play Store). This article will mainly cover the former.

What are the benefits of Google app campaigns?

App campaigns offer three core benefits compared to other app channels:

1. Unique inventory access: Google properties are not sold anywhere else

(unless if you run web campaigns with Google Ads).

2. Scale: Google’s ad inventory is massive — each of the channels above has the potential to scale to virtually unlimited volumes. Google claims a reach of 1b+ users on each of the placement.

3. Low maintenance: Being vastly automated, the amount of manual work required is minimal, saving on management costs.

The differences between Android & iOS campaigns

Google app campaigns present significant differences across Android and iOS.

On Android, Google app campaigns offer a large range of placements and benefits from having access to data on both sides. This advantage made Google app campaigns the leading advertising channel on Android, with a market share estimated beyond half of all paid installs served!

On iOS not all placements are available, as the valuable ads shown in the Play Store (both in search and display) are obviously not available. iOS app campaigns will mainly run on display via Admob (ads in other apps), search on Google.com (or the app), and YouTube.

Google does not use SKAdNetwork data to optimize campaigns. At least not yet — a beta running in 2023 and the new capabilities of SKAdNetwork 4.0 (which includes web conversions from Safari) are likely to change this in coming months or in 2024. Google uses a conversion modeling system that extrapolates from ad engagement and the few observable conversions to estimate how many conversions might have happened. Because Google also does not request ATT permissions in its own apps, the user-level data signals are limited (still observable in Admob when there is double ATT opt-in or for the very small % of users who haven’t updated their OS since iOS14.5).

Google app campaigns’ position in the market

Launched in 2015, app campaigns generated 17 billion installs from ads by 2019. Google stopped communicating figures and doesn’t share app specific figures in its financial reports, but this shows both massive inventory and rapid adoption by advertisers which has only gone up since.

InMobi’s Appsumer benchmarks offer more details about the massive scale of app campaigns

(95% adoption among advertisers, closely followed by Apple Search Ads):

- 34-37% share of wallet (#1, Facebook around 25-30%) and 56% among advertisers spending less than $250k per month (source)

- A significant difference across OS, with more than half of advertising budgets on Android but less than 10% on iOS

How to set up Google app campaigns

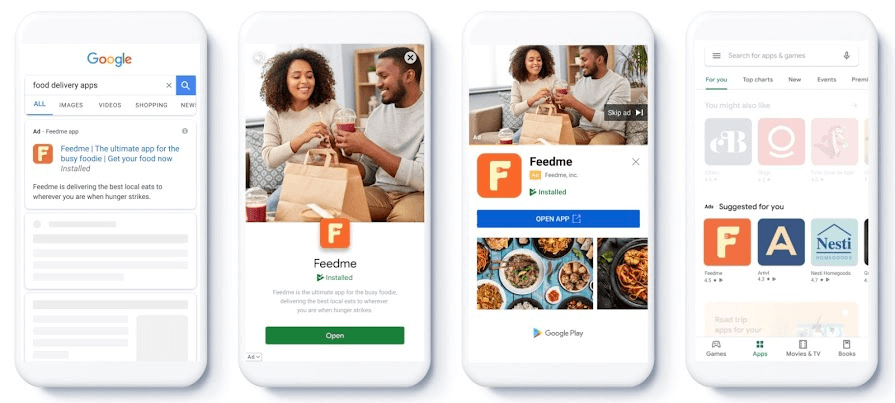

Within a Google Account, app campaigns are a particular objective you see when creating a new campaign, under “App promotion”:

From there, it’s quite straightforward!

GAC are vastly automated. There are five main inputs left for marketers (on top of the campaign type mentioned previously). The campaign creation wizard will help you fulfill them all:

1. Daily budget: how much money can the campaign spend every day?

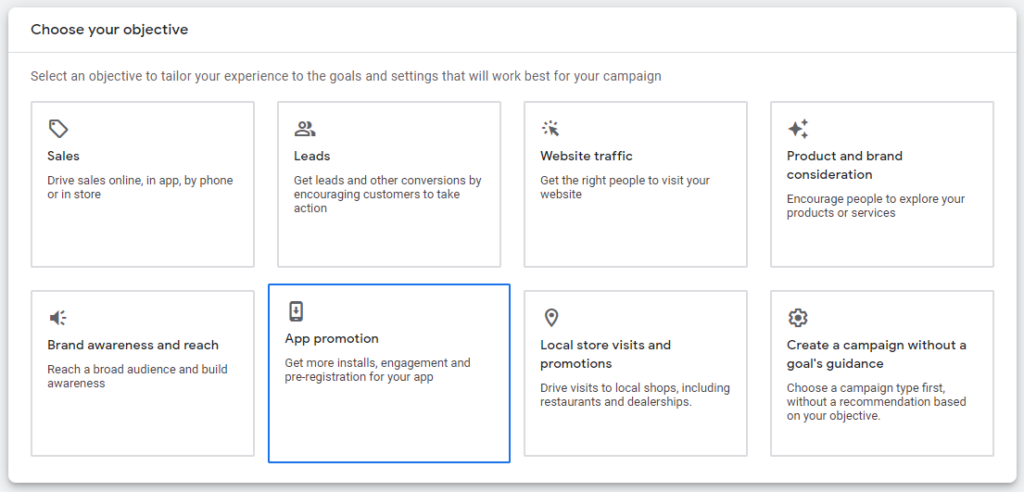

2. What you want to optimize for: installs, installs most likely to complete an in-app event, in-app events, or value optimization (if revenue is passed). This choice may impact volume (from most to least) and performance (from least to most).

3. The bid for this optimization (ex: $1.00 CPI). Google calls “tCPA” the target cost per in-app actions. In the case of value optimization, the bid is called tROAS (target return on ad spend) and corresponds to a %.

4.Location (and languages)

5.Creatives (detailed below)

Note that there is no option whatsoever about audience targeting. GAC doesn’t provide the option to only show ads to a specific gender, interests, devices, or OS versions.

Conversion tracking

Maybe the most critical input marketers can give are the conversions. This should be done before campaigns run, in “tools and settings” > conversions.

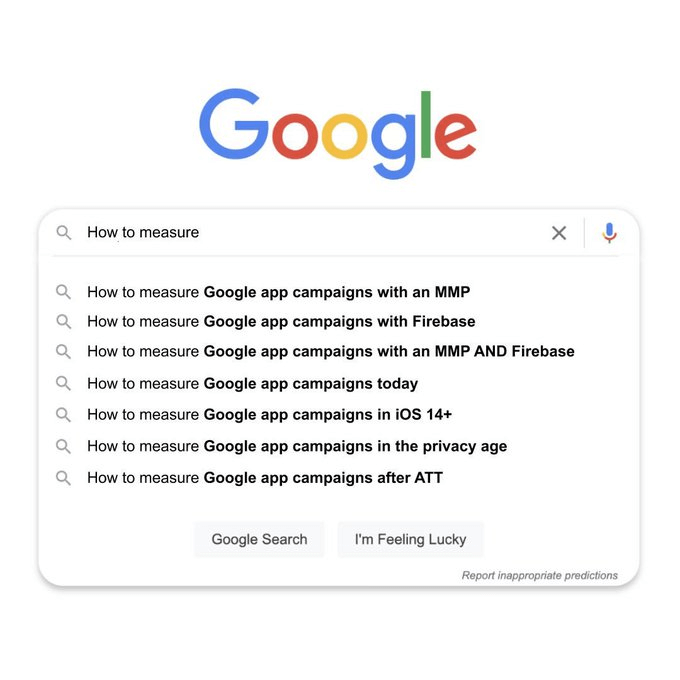

The source of conversion matters — your two main choices being to send them via Firebase or a mobile measurement partner (MMP). Google aggressively recommends using Firebase as the source of input, claiming higher performance, and restricts some features, like being able to exclude existing users, to advertisers who integrate Firebase.

Learn more about app conversion tracking here

For Android campaigns, you want to have your Play console linked to the account, which improves the flow of data between both and unlocks some features.

Beyond the source of conversion, you want to pay attention closely to what you’re optimizing for. Higher funnel events (such as registrations or tutorial completed) may give more events, but not be aligned with long-term revenue or retention goals. Lower funnel events (such as trials converted or renewals), may be too few and too delayed to enable proper optimization.

There are a few additional settings you might check, including view-through conversions and conversion windows (more documentation here). Be aware that shorter windows will report fewer conversions, but longer windows might skew the accuracy of attribution.

Creative assets

Besides your choice of conversion, creatives are the other main lever for campaign performance. Google recommends to provide a variety of formats, to give the platform more opportunities to reach your potential audience. For instance, if you don’t have any videos, you won’t get delivery on valuable placements, such as YouTube.

There are four (+1) formats of assets

- Text: provide various shorter (headlines) and longer (description) text input

- Video: these asset must be hosted on YouTube (no direct upload)

- Images: with a variety of formats

- HTML5: for playables, maybe the least critical for non gaming)

- Note that the existing assets of your store listing can be used as creatives too

Here are a few basic tips for the content of your creative:

It’s important to note that those are not final creatives but creative “assets” and Google might recombine different elements into a creative, but reporting only shows asset performance.

Google will show you an “ad strength” index, which only covers formats but doesn’t evaluate the potential of assets. In this example, all formats were provided and ad strength is at maximum, but the account may still lack landscape videos:

See more official recommendations

Practical tips for success with Google App campaigns

In the first part, we’ve seen what Google App Campaigns are, what makes them unique, and how to get started. Now let’s see in more detail how to make them work for your apps!

Tip 1. Be patient! Advanced machine learning is slow to learn

Due to their mechanics based on machine learning, App campaigns have a learning period.

When you start, it is likely to take some time and a scarily significant amount of money to collect enough data, from ad engagement to conversions, to start optimizing properly. Sadly, for smaller advertisers, this system requires large amounts of time and data to start learning where and who your best potential users are and which creatives make them tick. I would recommend against even starting if you can’t hold for a couple weeks and a 100+ events…

Once campaigns run, you also don’t want to make too many changes too often, which can reset the learnings. For instance, if you want to increase budget on a performing campaign, you might want to only raise by 20% once or twice a week. There is no exact frequency, but in general, less change is best.

More often than not, the best you can do is wait and analyze results, rather than edit bids, budget, and goals.

Tip 2. Budget and bidding

Your budget and bids should be big enough to generate the events needed for machine learning optimization. There is also no exact number, but more is better, but as a rule of thumb I would recommend having the values of bid and budget aiming at generating at the very least 10 events per day. Expect better performance if you are able to generate 50+ or more.

When setting up your daily budget, be aware that Google might spend more than what you input. It is common to see twice as much as defined at the start, when performance is worst, which may readjust down later if you don’t edit it further. This is to accelerate learning, but also a dark pattern to siphon a maximum of budget before performance appears.

Sylvain Gauchet learned it the hard way, with significant budgets being spent in the first days:

When setting up your bid, you might want to observe:

- the CPA you get on other networks, for this particular combination of geographies and platform

- actual CPA, if you have run campaigns before

- maybe most importantly, the revenue your app is generating from this event, within a given timeframe

For instance, if an app is making an average of $10 of revenue per trial, and aims at a 2x return on investment, it should bid $5. Whether this is possible will define success or failure. For a variety of both good and wrong reasons, Google recommends to bid higher than you aim for, +20% being mentioned sometimes by account managers (hence $6 in the case above). Setting a higher bid than you can afford may be unprofitable for you, but it will also accelerate the learning phase and avoid the campaign stopping delivery.

There is one particular situation that often occurs, especially at the beginning. If your bid (tCPA) is too low, and Google isn’t able to provide conversion at the requested price, CPA will be higher than tCPA (tCPA is not a guarantee of CPA!) and the budget will still be spent trying. This is called “overshooting”. After a while, the campaign delivery will most likely decrease to little or even nothing, sometimes before enough events are generated to start optimizing towards the CPA goal. When facing this situation, you might want to consider:

- Increasing your bid.

- Using another event higher in the funnel or with more frequency.

- Updating your assets, bundling different countries.

- Abandoning the channel: it can’t deliver at the level you expect.

But, by then, a sizable chunk of the budget will have been spent unprofitably…

Tip 3. Optimize (mainly) for in-app actions

Campaign structure: installs vs events and overlapping campaigns

Some advertisers first run campaigns optimizing for installs to collect data before switching to events (tCPA). In general, I avoid running install campaigns (without events). Those might bring more scale and cheaper CPI, but they often also bring installs with very low value. I also avoid switching the optimization of an existing campaign.

In specific cases, you might want to run both in parallel. Suppose you’re attracting very different kinds of users — a much lower bid on the CPI campaign could be delivering on different placements and audiences, for which you would want to adapt creatives accordingly. It is recommended not to run two campaigns on the same optimization in parallel.

Google and experts recommend to avoid overlapping two campaigns in the same country with the same optimization goal, as Nataliaa Drodz highlighted in the Mobile User Acquisition show:

Which event(s) for subscription apps?

For subscription apps, it’s most common to optimize towards free trial starts (in the case that an app uses a free trial) because:

- Install campaigns usually bring low-quality traffic.

- Converted trials and renewals are too far down the funnel to bring enough volume without delay to enable optimization (this may not apply if you operate at massive scale with a short period of free trial or not at all).

- Value optimization can be powerful for businesses with a large variance in revenue (such as gaming or ecommerce). A large share of subscriptions do not necessarily have this, and tROAS campaigns typically require higher budgets to learn and scale and a higher quantity of data to provide accurate revenue estimates.

All in all, most subscription apps use trial started as their core conversion: trials are an event that happens often enough and early enough to enable optimization, while having decent correlation to revenue. It’s not perfect either, by far, and each app should evaluate what’s in it’s best interests as well as ability. With enough volume, you could also provide a layer of filtering on top of trials, for instance “free trials who didn’t cancel the auto renewal within 2 hours”, or “free trials who completed the core action twice within two days”.

If you offer various plans — monthly and yearly, free trial and upfront subscription, various prices etc. — for various events of different value is not really a case most ad networks offer a clean solution to. You then have various choices available:

- Simplistic but efficient: I would recommend optimizing towards any kind of subscription starting, even though this may render complex the modelization of revenue and ROI as each have different LTVs. This gives Google a better chance to generate valuable conversions. You can do that by either adding every single event apart or by bundling all subscription starts within one event, which is my preferred choice (less granularity, but simpler).

- Use a value workaround: you could tweak your events to better represent their value. For instance you could decide that a particular plan would trigger two conversions, if you think it brings twice the LTV. Google may or may not interpret this properly and this convoluted conversions setup can also make results more difficult to analyze, given not all events have the same value.

- More precise but complex: if your plans have big variance (for example, a type of product bringing $10 in LTV and another $100), you may want to provide the value of the conversions and switch to “tROAS”. This type of campaign requires Firebase to be installed, an account manager to unlock the campaign, as well as typically higher budgets to operate properly (more data needed) and a reliable and sophisticated way of predicting revenue for each plan. While powerful on paper, tROAS was mainly designed for gaming and I haven’t seen yet a significant advantage for subscriptions.

Tip 4. Recommendations for creative assets

As mentioned previously in part one, the general guidance is to provide a variety of formats so the system can explore placements and audiences.

At first, aim to have pretty much all of them, with at least two or three assets each!

You are limited by 20 per category and by your own production capacity.

Images

There are 32 image dimensions, but you should be able to cover most with the following three ratios:

1.91:1 (e.g. 1024×628, same as your feature graphic on Play)

6.4:1 (e.g. 320×50, typically small banner that generates a lot of impressions with little impact)

1:1 (e.g. 250×250)

Videos

With videos, you definitely want to have two portrait, two square and two landscape, and see what happens with each. The more the better.

I strongly recommend you also test various lengths, in particular 6, 10, 15, 30 seconds. These combinations of size and length may all show up in very different places to different users.

Text assets

Regarding copy, you want to ensure they make sense independently: be mindful that text may be recombined in unpredictable ways. Using punctuations can help in some cases.

GAC has various dark sides, and reporting is one of them: what users see is not reported to the advertiser, so you have to anticipate those possible recombinations, without really knowing what may happen (Google can also use your store text without disclosing it).

AI-generated assets

A recent trend has been to use chatGPT to generate an unlimited amount of headlines and descriptions. Be as specific as you can when prompting, then just like with copy you create yourself: test and iterate constantly. I usually use a combination of AI generated and internal copy and put them in competition.

Creatives in ad groups

A couple years ago, Google added “ad groups” into GAC. Those work a bit differently than on other networks, and are meant to group creative assets by “theme”. This could be a seasonal campaign, or a visual style, a specific message, or anything that makes sense to group differently to the rest.

I typically have an “evergreen” ad group with creative winners, alongside a couple of others where more rotation happens.

Note that you can not edit any setting at ad group level (e.g. by language), and that for optimization you want to aim at a volume of conversion per ad group, not overall for the campaign.

Content

Format is the more technical part. You want to focus on the content itself and test a variety of messages and concepts to understand what ticks with the audience and test. That’s true for all categories of assets!

At first, be radical, trying very different approaches — you will only produce variants of a concept once it shows traction. Try to be as diverse as possible. Some assets may only address a portion of the audience or a specific feature. Mix questions and affirmation. Use polished imagery as well as user generated content. Testimonials or TV-ad style. Etc.

Once you have provided this wide range, start running campaigns and wait for data to kick in. Besides adjusting bids and budget and possibly locations, ongoing optimization is done in large part by monitoring the “asset ratings” and replacing worst performing assets with newer ones. To access the performance ratings, within a campaign or ad group, go to the “asset” tab, where Google rates your performance with “Best”, “Good”, or “Low”.

I advise to split by asset category (such as headlines or videos) and not compare assets cross category (engagement rate may differ vastly).

You may want to remove the “low” performance and replace them with new concepts.

If an asset never delivers there’s no reason to keep it too long. You could also try to edit it slightly and re-run it or split in another ad group.

Finally, you may want to keep not just the “Best” rating assets, but those with good delivery (scale) and other signals of performance. Do not check not just the ratings, but also a number of secondary metrics such as engagement rate, CTR and modeled CPI and CPA.

In the example below, the “best” headline and video don’t have the best CTR, and neither did they bring lower CPI nor CPA, but Google still decided somehow they were the best.

Ad journey personalization: “one size fits all”!

For now, GAC do not support Apple’s Custom Product Pages, nor Google’s own Custom Store Listing (for which the beta was shut down before it got open), so you can’t personalize what users will see in the store after they engage on your ads. Acquisition campaigns do not support deep links to give a personalized experience within your app.

However, as announced at Google I/O 2023, “soon” Google will “launch custom store listings for Google Ads App campaign ad groups. These will allow you to serve custom listings to users coming from specific ads on AdMob and YouTube so you can create a more seamless user experience from Google Ads to Google Play.”

Tip 5. Analyzing performance

There are at least four ways to monitor the performance of your campaigns:

- Retrieve data from the API and display it on your side (for instance in Tableau or Looker)

- Use Google Ads partners who offer this functionality out of the box

- Export specific reports

- Use the interface

To go deeper on this last one, here’s one of the actions I perform most regularly.

When entering the account, I dismiss persistent notifications, overview, recommendation, and insights that don’t offer much granularity, when not entirely irrelevant. I also barely look at the default graphs and their limited formatting options, except to get a glance at money spent or to make simple comparisons (e.g. did impressions grew as much as spend)

Instead, where I spend most time is within the “campaigns” tab (or in other cases, ad groups within a campaign). Here you can have predefined filters to only see live campaigns of a given type, and edit the columns that are most relevant to you (save the preset!). I typically use “segment” to break down valuable information about placement, days or devices.

Note that if you segment by “days”, the timeframe will be limited to two weeks, limiting your ability to properly read trends. This limitation forces you to export reports manually to go beyond 14 days (and there, one can’t export costs and conversions at the same time, forcing you to make manual joins!). Good luck joining, and when tired, remember there are two other better ways to get your data than interface and export: the API and third-party tooling.

Tip 6. Keep a close eye on incrementality

App campaigns conversions are “modeled”, which have some benefits (Google pitches them here) and severe drawbacks.

Attributed conversions may have happened thanks to a Google ad or maybe not! And thanks to “AI” modeling, nobody can actually know why the prediction was made. Use them directionally but not at face value. Sometimes modelization goes wild.

They also live in isolation: Google doesn’t have access to what other channels have generated, and the same conversion might be reported simultaneously on GAC and from other networks. Because they are modeled, conversions only live within Google Ads and can not be properly audited nor deduplicated by third party tools.

Advertisers are also unable to measure precisely the long-term development of their cohorts, and those trials (for example) generated may show a very different revenue and retention curve than the rest of your traffic. They are also likely not to have the same revenue and retention on each placement! This level of obfuscation is really limiting marketers to properly evaluate the return on investment.

There’s always a significant risk to give the fox the keys to the hen house. Letting an ad seller run attribution is pretty much the same. Here, with modeling on top, from limited observable data points, and without any possibility of auditing.

To ensure that the conversions generated by GAC are actually moving the bottom line on your side, and not just made up so you increase your budget on the platform, it is strongly recommended to run incrementality analysis or use media mix modeling to infer the actual impact. Such methods are not very accurate for campaign optimization, but they should inform if the money invested is actually yielding positive returns.

A relatively simple way to start would be to isolate the spend of a particular country and platform, and invest sufficiently to observe the effect over the total of your traffic (if GAC is generating 1% of all subscriptions, it’s unlikely that it will be possible to infer its impact).

In a few cases, I’ve seen GAC reporting more conversions that happened that day across all traffic sources, so take the value in the dashboard with a pinch of salt. Here’s an example.

If this incrementality methodology sounds complicated to you, that’s because it is!

But if the alternative is to just trust Google’s advanced machine learning, remember the primary goal the algorithm optimizes for:

Tip 7. Search Keywords in GAC

Google App campaigns give access to highly valuable search ads inventory on Google Search (web or app) and on the Play Store.

Sadly, there is no mechanism to either select the keyword you want to bid on or get reporting about it. You can’t run search-only campaigns either, and even in the case where most of your conversions come from this network, you will still get part of your budget spent on lower performing placements. It’s by design and there is little you can do about it.

It’s all the more frustrating that search ads data is extremely valuable for a number of actionable insights, like improving your store listing (ASO). In another post on the RevenueCat blog, I shared how to use Apple Search Ads data to keep improving, which isn’t available here.

Going deeper with keywords on GAC:

1. While you don’t get a split of organic vs paid, since 2017, Play Console provides data on which search terms generate installs and their conversion rate. If you start or stop campaigns at some point, you might be able to infer some of the terms that are used on GAC, although this is not very precise, nor will it provide post-install data

2. Add negative keywords to your accounts

There are a number of GAC features that are not available in the UI, and only advertisers with a minimum amount of spend and the support of a dedicated account manager can access them. If they know about them. One such hidden feature is the ability to use negative keyword lists. To keep control on your side, ask for a list to be whitelisted, then add and remove keywords and monitor performance.

However, Google communicated just a week before publishing this guide that account-level negative keywords will be available in app campaigns to everybody “soon”.

3. Branded keywords

A number of conversions from GAC will come from searches on your own app name, in Google search and on the Play Store. There is no way to separate those and analyze them apart. They typically inflate performance of your campaign, but are not necessarily incremental.

Have you ever looked at your #UAC performance after blocking brand keywords?

— Thomasbcn (@Thomasbcn) December 21, 2022

To understand the weight of a branded keywords, you can add and remove them from your campaigns to infer the performance of GAC without them, and to study if the incrementality is worth having them running.

4. Text only campaigns?

As a number of marketers look to maximize their exposure on search while minimizing waste on display, one common tactic has been to only add text assets to a campaign (or ad group). While this sometimes yields results, Google will create automatic ads based on text and your store listing to still deliver on its app network Admob, rendering the attempt counterproductive as not only will delivery continue, but the creatives are likely to look worse than the material you provide and iterate on.

Tip 8: Pre-registration campaigns

Google App Campaigns has an option to promote an app before its official launch, when it’s in “pre-registration” mode on the Google Play Store. For this, the app has to be submitted as pre-registration (see official documentation).

In this case, Google will show ads to users on its networks in a similar manner to the normal campaign, the conversion being replaced by a “pre-registration”, which is what advertisers will be bidding on. These campaigns are pretty straightforward to run.

Tips for pre-registrations:

- make sure you specify countries properly (especially if the pre-registration is not available everywhere)

- campaigns will stop when the app gets released: switch to the usual campaigns then

- be mindful about the budget you are investing in those: a pre-registration may or may not convert into a download later. If the pre-registration runs for a long period (there is a maximum of 90 days), the likelihood is lower.

“It’s not a bug, it’s a feature”: pre-registration case study from the Sub Club forum

A developer reported on Sub Club to have tried this kind of campaign when launching their Android version. After investing 5-digits to attract pre-registrations from the campaign, less than 1:10 actually converted into actual installs, and what initially looked a reasonable cost per pre-registration translated into very high CPI in the end. The developer thought this was a bug, but the developer support replied that “the decrease in your installs after launching your app versus the number of users pre-registered to their app is working as intended”

My personal take is that those campaigns are pretty niche, and I would recommend to mostly avoid pre-registrations and the related ad campaigns. They can make sense for very specific use cases, usually bigger brands who are able to build large interests ahead of launch from outside the store, because of existing audience and/or well known IP, such as Super Mario which was the first app to get a pre-registration. They can also enable marketers to start testing ASO assets before the very first APK is ready and get ready for launch, but I wouldn’t invest too much budget into that. Instead, consider releasing as soon as possible and start iterating — without losing pre-registration never becoming an install hence an active user — and reserve marketing budget for your live app.

Tip 9. Other comments…

Campaign structure and “bundling”

App campaigns require a significant amount of data (and budget) to run properly, by consequence it is recommended to limit how many campaigns you run in parallel, spreading your budget thin.

On some occasions, you may want to bundle locations together, to consolidate the investment into bigger campaigns that get more data, learn faster, and perform better.

You may want to group locations that show a relatively similar pattern in terms of value per event you are trying to optimize for. For example, if you generate $10 per trial in country A and $40 in country B and have both together, how much will you want to bid? Unlike regular Google ads campaigns, GAC doesn’t offer “bid modifiers”.

Location settings

The GAC interface has a number of small dark patterns. One potential money drainer is that the ads might show in places that you did not select. When picking up locations, expand the detailed settings to move from the recommended default “people who’ve shown interest in your targeted location” to “people in your targeted locations”.

This will limit unwanted inventory and make external analysis more accurate.

Video only campaigns

Advertisers can’t select placements they do not wish to advertise on and they can’t exclude placements that consistently bring low-quality traffic (somehow, the “advanced machine learnings” keeps delivering paid impressions that don’t convert even after months and gazilions of impressions…)

But through the help of an account manager (this isn’t available in the interface), they can run “video only” campaigns that will only show in YouTube and Admob.

Audience exclusion

If you use Firebase (this option is not available when using third-party app analytics providers), you have the possibility to use an exclusion list, for instance to avoid your active subscribers to keep seeing your ads.

App campaigns placement

By default, the interface offers little detail about how and where your ads show up and how they perform. But there is a hidden report disclosing more. Head to “Reports”, “Predefined reports (dimensions), “other”, “app campaign placements” (!) to unveil some information about which apps showed your ads.

Regrettably, this report has been vastly simplified and will now only show total impressions, obfuscating critical performance metrics.

Recommendations…

The UI surfaces a number of recommendations that may or may not be relevant, or even in your best interests. If you dismiss those, they’ll keep coming. Keep an eye on them, but think twice before applying any.

There are a number of memes among marketers about that, some of the best coming from Yamil Amed Abud:

Google app campaigns for iOS

For obvious reasons, the valuable placements from the Play Store are not available.

Since iOS 14.5 and ATT in 2021, IDFA is only available in a minority of cases. It is irrelevant in the case of search, as well as for YouTube where Google doesn’t request ATT. Google is the only channel that hasn’t adapted to use SKAdNetwork 3.0 for optimization.

Combined, all these reasons have severely limited the potential of this channel for iOS advertisers.

You can access a SKAdNetwork conversions report in “Reports”, “Predefined reports (dimensions), “other”, “SKAdNetwork conversions” (!). In this report, note that by default, Google considers as a conversion those that its network merely “assisted” but were credited primarily to another source (!). You can and should segment those by adding the “SKAdNetwork attribution credit” column. This report also enables you to see YouTube vs all other placement.

There is light in the tunnel in 2023:

- Google announced a beta that uses the aggregated data from SKAdNetwork to optimize & report conversions

- SKAdNetwork 4.0 is adding capability for web-to-app conversions (on Safari only, which is the leading browser on iOS), as well as additional conversion inputs, with longer timeframe and more possibility to measure performance at creative or country level.

The story develops, but Google finally embracing SKAdNetwork could change the way App Campaigns perform in 2024 and beyond.

Conclusion

Google app campaigns are a very scalable, mostly automated way to promote your app.

As illustrated by its impressive market share, it’s a channel with huge potential on Android where Google owns more inventory and can observe tracking data on both sides.

On the other side of the coin, it also requires a minimum budget to run properly, a solid dose of patience and tolerance for uncertainty, and some tricky monitoring about actual performance.

Its inner mechanics are mostly a black box, and even Google support will struggle to explain why delivery happens in a certain way and what to do about it.

Choose very carefully what to optimize towards, then iterate progressively on creatives.

Ready to roll the dice?

Further reading: Explore Thomas’ guide to Apple Search Ads

In-App Subscriptions Made Easy

See why thousands of the world's tops apps use RevenueCat to power in-app purchases, analyze subscription data, and grow revenue on iOS, Android, and the web.